Recommended Searches:

Partiful

AFK Journey

Max

Clash of Clans

Mila

UpStudy

MacroFactor

Timeleft

Baby Daybook

Infinite Painter

Peacock TV

Squad Busters

Eggy Party

Honkai

Kingdom Rush 5

Cookie Run

Latest Version

Version

24.5.2

24.5.2

Update

May 24, 2024

May 24, 2024

Developer

Expense tracking made simple

Expense tracking made simple

Categories

Finance

Finance

Platforms

iOS

iOS

File Size

103.7 MB

103.7 MB

Downloads

0

0

License

Free

Free

Report

Report a Problem

Report a Problem

More About Stride: Mileage & Tax Trackerlication

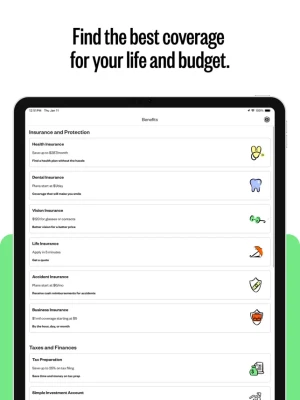

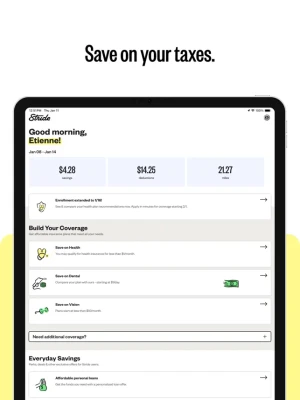

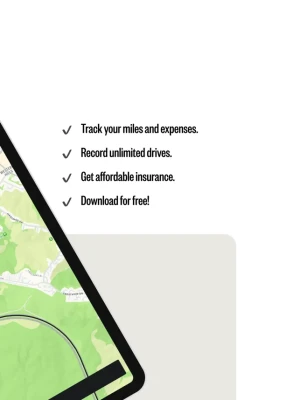

One free app. Everything you need for independent work. Track mileage & expenses to save an average of $710/year on taxes, plus access insurance, everyday deals, & more.

Stride is the FREE mileage and expense tracking tax app that helps you save thousands on your tax bill all year round. It automatically maximizes your mileage deductions, imports expenses, helps you find money-saving write-offs, and makes filing a breeze.

Built and designed for people who work for themselves, Stride’s mileage tracker helps you discover business expenses you can claim as an independent worker and makes filing a breeze. Most people save $4,000 or more at tax time by using Stride’s expense and mileage tracker!

Stride’s mileage and expense tracker helps you:

+ Save big on taxes

+ Track miles automatically

+ Log expenses like car washes and your cell phone bill

+ Take the hassle out of filing

=================================

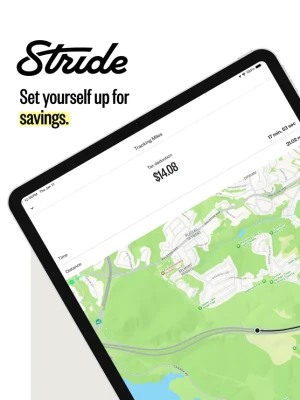

Automatically maximize mileage deductions

=================================

Just press Start when you leave the house, and Stride’s mileage tracker will automatically maximize your mileage deductions and capture them in an IRS-ready standard mileage log format. Stride’s expense tracker users get $670 back for every 1,000 miles they drive!

+ Automated GPS mileage tracking

+ Reminders to make sure you never miss out on miles

+ IRS-ready mileage logs to audit-proof your deduction

=================================

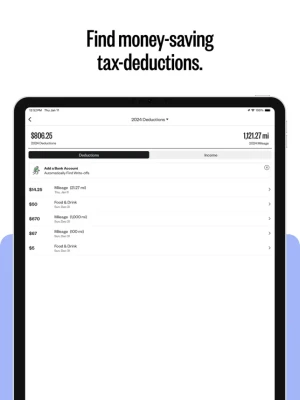

Find money-saving write-offs

=================================

We find all the expenses and deductions based on the work you do. On average, Stride finds users $200 worth of write-offs each week.

+ In-app guidance on what expenses you can deduct and how to best track

+ Bank integration to easily import expenses

=================================

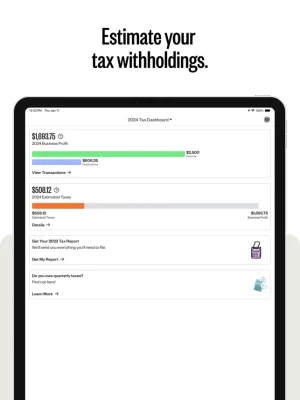

Get an IRS-ready tax report for easy filing

=================================

We prepare everything you need to file in IRS-Ready reports. Stride’s mileage and expense tracker users cut their tax bill in half on average (56%).

Gather all the information needed to file an IRS-ready report

Support with all filing methods: e-file, tax filing software, accountant

Have all the information you need to audit-proof your taxes

--------------------------------------

Stride’s expense and mileage tracker is great for:

+ Rideshare drivers

+ Delivery drivers

+ Entertainers

+ Creative professionals

+ Business consultants

+ Sales agents

+ Real estate agents

+ Home service professionals

+ Caregivers

+ Rental hosts

+ Insurance agents

+ Hairdressers

+ And many more!

Built and designed for people who work for themselves, Stride’s mileage tracker helps you discover business expenses you can claim as an independent worker and makes filing a breeze. Most people save $4,000 or more at tax time by using Stride’s expense and mileage tracker!

Stride’s mileage and expense tracker helps you:

+ Save big on taxes

+ Track miles automatically

+ Log expenses like car washes and your cell phone bill

+ Take the hassle out of filing

=================================

Automatically maximize mileage deductions

=================================

Just press Start when you leave the house, and Stride’s mileage tracker will automatically maximize your mileage deductions and capture them in an IRS-ready standard mileage log format. Stride’s expense tracker users get $670 back for every 1,000 miles they drive!

+ Automated GPS mileage tracking

+ Reminders to make sure you never miss out on miles

+ IRS-ready mileage logs to audit-proof your deduction

=================================

Find money-saving write-offs

=================================

We find all the expenses and deductions based on the work you do. On average, Stride finds users $200 worth of write-offs each week.

+ In-app guidance on what expenses you can deduct and how to best track

+ Bank integration to easily import expenses

=================================

Get an IRS-ready tax report for easy filing

=================================

We prepare everything you need to file in IRS-Ready reports. Stride’s mileage and expense tracker users cut their tax bill in half on average (56%).

Gather all the information needed to file an IRS-ready report

Support with all filing methods: e-file, tax filing software, accountant

Have all the information you need to audit-proof your taxes

--------------------------------------

Stride’s expense and mileage tracker is great for:

+ Rideshare drivers

+ Delivery drivers

+ Entertainers

+ Creative professionals

+ Business consultants

+ Sales agents

+ Real estate agents

+ Home service professionals

+ Caregivers

+ Rental hosts

+ Insurance agents

+ Hairdressers

+ And many more!

Rate the App

Add Comment & Review

User Reviews

Based on

No reviews added yet.

Comments will not be approved to be posted if they are SPAM, abusive, off-topic, use profanity, contain a personal attack, or promote hate of any kind.

More »

Popular Apps

Telegram 5Telegram FZ-LLC

Water Connect FlowIEC Global Pty Ltd

Car Mechanic Job: SimulatorCar Simulator Crafting & Building FPS Arcade Games

MyBambuBetter Than Banking

School PlannerAndrea Dal Cin

Standoff 2Axlebolt

Warlords of AternumInnoGames GmbH

InstagramInstagram

Battlelands RoyaleFutureplay

My Singing MonstersBig Blue Bubble

More »

Editor's Choice

Hopeless Land: Fight for SurvivalHK HERO ENTERTAINMENT CO.,LIMITED

Last Shelter: SurvivalLong Tech Network Limited

Toy Defense Fantasy — Tower Defense GameMelsoft Games

Warlords of AternumInnoGames GmbH

Vikings: War of ClansPlarium LLC

King of ThievesZeptoLab

MachinariumAmanita Design

Egg WarsBlockman Go Studio

Murder in the AlpsNordcurrent

Battlelands RoyaleFutureplay