Latest Version

Version

1.21.0

1.21.0

Update

April 27, 2024

April 27, 2024

Developer

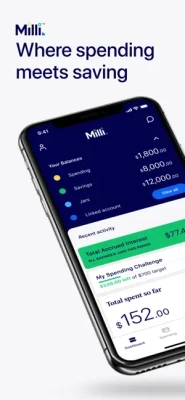

Where spending meets saving

Where spending meets saving

Categories

Finance

Finance

Platforms

iOS

iOS

File Size

93.7 MB

93.7 MB

Downloads

0

0

License

Free

Free

Report

Report a Problem

Report a Problem

More About Milli: Mobile Bankinglication

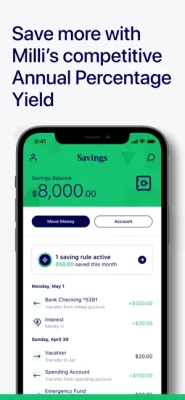

Earn 4.75% Annual Percentage Yield* with Milli's Savings Account and Jars - no fees or minimums. Accurate as of 02/29/24. To learn more visit: https://milli.bank/

Say hello to Milli - A mobile bank on a mission to help you spend smarter today and save more for tomorrow.

Milli is built to help you create better spending habits while you grow your savings. You work hard for your money, so we believe your money should work hard for you. That’s why we offer tools that allow you to analyze your spending in real time with our Milli Visa® Debit Card, while also offering a highly competitive annual percentage yield on your Savings account and Jars.

GREAT RATE, GREAT RETURN WITH OUR COMPETITIVE APY*

When you join Milli, you'll unlock access to our competitive interest rate applied to both your high yield Savings account and Jars. Track your accrued interest any day, any time on your Milli dashboard, so you’ll always be able to see the progress you’re making towards your savings goals.

NO MINIMUMS. NO FEES. NO FUSS.

Banking shouldn’t cost you a thing. That’s why there’s no fees and no minimums with your Milli account, keeping your money as your money.

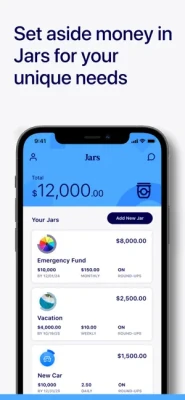

MILLI JARS, YOUR POCKET PIGGY BANK

Milli’s Jars are a personalized savings experience, built by you. Create up to 5 customized digital Jars with Milli, upgrading how you save for upcoming purchases. Plus, you’ll earn our competitive savings rate on the balance in all of your Jars. Financial goals aren’t one size fits all, so your savings account shouldn’t be either.

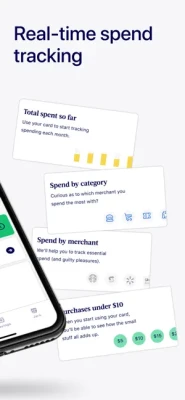

SPEND WISELY WITH MILLI

Real-time spend tracking lets you easily track your spending by category, retailer, or dollar amount. With the Milli Visa Debit Card, you’ll know where every dollar goes, so you can make the most of every dollar left.

INSURED AND ASSURED

As a Member FDIC Bank, your deposits are insured up to $250,000, safeguarding your savings and giving you peace of mind.

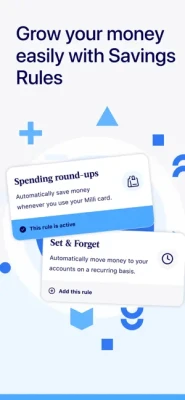

EFFORTLESSLY SAVE WITH RULES

Challenge accepted! Get the most out of every penny and create better habits with our auto-save rules.

With Set and Forget, Milli will automatically move money into your savings. When you swipe the Milli Visa Debit Card and use Spending Round-Ups, Milli will round up the purchase price to the nearest dollar and add that extra amount to savings.

55,000 SURCHARGE-FREE ATMS WORLDWIDE

Milli is part of the Allpoint® ATM Network, providing access to 55,000 surcharge-free ATMs worldwide.

Spend Smarter Today, Save More for Tomorrow.

*Milli Savings Account and Jars Annual Percentage Yield is subject to change. Rates may also change after the account is opened. See the disclosures for additional information and limitations.

Copyright © 2024 First National Bank of Omaha. All rights reserved. Milli is a division of First National Bank of Omaha. 1620 Dodge Street, Omaha, Nebraska, 68197.

Milli is built to help you create better spending habits while you grow your savings. You work hard for your money, so we believe your money should work hard for you. That’s why we offer tools that allow you to analyze your spending in real time with our Milli Visa® Debit Card, while also offering a highly competitive annual percentage yield on your Savings account and Jars.

GREAT RATE, GREAT RETURN WITH OUR COMPETITIVE APY*

When you join Milli, you'll unlock access to our competitive interest rate applied to both your high yield Savings account and Jars. Track your accrued interest any day, any time on your Milli dashboard, so you’ll always be able to see the progress you’re making towards your savings goals.

NO MINIMUMS. NO FEES. NO FUSS.

Banking shouldn’t cost you a thing. That’s why there’s no fees and no minimums with your Milli account, keeping your money as your money.

MILLI JARS, YOUR POCKET PIGGY BANK

Milli’s Jars are a personalized savings experience, built by you. Create up to 5 customized digital Jars with Milli, upgrading how you save for upcoming purchases. Plus, you’ll earn our competitive savings rate on the balance in all of your Jars. Financial goals aren’t one size fits all, so your savings account shouldn’t be either.

SPEND WISELY WITH MILLI

Real-time spend tracking lets you easily track your spending by category, retailer, or dollar amount. With the Milli Visa Debit Card, you’ll know where every dollar goes, so you can make the most of every dollar left.

INSURED AND ASSURED

As a Member FDIC Bank, your deposits are insured up to $250,000, safeguarding your savings and giving you peace of mind.

EFFORTLESSLY SAVE WITH RULES

Challenge accepted! Get the most out of every penny and create better habits with our auto-save rules.

With Set and Forget, Milli will automatically move money into your savings. When you swipe the Milli Visa Debit Card and use Spending Round-Ups, Milli will round up the purchase price to the nearest dollar and add that extra amount to savings.

55,000 SURCHARGE-FREE ATMS WORLDWIDE

Milli is part of the Allpoint® ATM Network, providing access to 55,000 surcharge-free ATMs worldwide.

Spend Smarter Today, Save More for Tomorrow.

*Milli Savings Account and Jars Annual Percentage Yield is subject to change. Rates may also change after the account is opened. See the disclosures for additional information and limitations.

Copyright © 2024 First National Bank of Omaha. All rights reserved. Milli is a division of First National Bank of Omaha. 1620 Dodge Street, Omaha, Nebraska, 68197.

Rate the App

Add Comment & Review

User Reviews

Based on

No reviews added yet.

Comments will not be approved to be posted if they are SPAM, abusive, off-topic, use profanity, contain a personal attack, or promote hate of any kind.

More »

Popular Apps

Car Mechanic Job: SimulatorCar Simulator Crafting & Building FPS Arcade Games

Warlords of AternumInnoGames GmbH

My Singing MonstersBig Blue Bubble

Standoff 2Axlebolt

School PlannerAndrea Dal Cin

HAWK – Alien Arcade Shooter. Falcon SquadMy.com B.V.

Toy Defense Fantasy — Tower Defense GameMelsoft Games

Battlelands RoyaleFutureplay

King of ThievesZeptoLab

Iron Tanks: Free Multiplayer Tank Shooting GamesExtreme Developers

More »

Editor's Choice

Hopeless Land: Fight for SurvivalHK HERO ENTERTAINMENT CO.,LIMITED

Last Shelter: SurvivalLong Tech Network Limited

Toy Defense Fantasy — Tower Defense GameMelsoft Games

Warlords of AternumInnoGames GmbH

Vikings: War of ClansPlarium LLC

King of ThievesZeptoLab

MachinariumAmanita Design

Egg WarsBlockman Go Studio

Murder in the AlpsNordcurrent

Battlelands RoyaleFutureplay